how to become a tax attorney reddit

As a tax attorney I was about to say pretty much the same things as Quora User who did a good job with a simplified answer to a question about a very complex area. But remember enrollment in or completion of the HR Block Income Tax Course is neither an offer nor a.

Top Rated Tax Resolution Firm Tax Help Polston Tax

Take finance and pre-law classes to prepare you for the LSAT and entry into law school.

. Ago B4 Transfer Pricing. In any event the issues are interesting and of vital importance to. As a first year lawcommerce student in Queensland the idea of becoming a tax lawyer seems quite appealing.

Any barred attorney can practice tax law legally. The nice thing about Tax Law is youll be employable and prestige is overrated. Choose a tax lawyer when receiving notices of debt.

Tax preparers are equipped to become a tax pro at HR Block. To be a Tax Attorney typically requires 2 -4 years of related experience. In fact the accounting field is expected to grow faster than the average career at a 6 growth rate according to the Bureau of Labor Statistics.

View the LSAC Official Guide to Canadian Law Schools for application procedures for the law school in which you intend to apply for admission. Its a difficult and expensive path take when a CPA track of 4 years or 41 is easier and less expensive. The Masters of Laws LLM Program The Masters of Laws LLM which stands for Legum Magister meaning masters of law in Latin is an internationally recognized postgraduate law degree.

The next step in the process of becoming a Canadian lawyer is to go to law school. In law school take electives and internships focused on tax policy. Almost no one applies to law school expecting to become a tax lawyer.

It seems to me. Press question mark to learn the rest of the keyboard shortcuts. The Tax Attorney occasionally directed in several aspects of the work.

This one-year program which is. To become a tax attorney it is important to earn a bachelor degree first. Its kind of difficult for someone whos a fresh 18 year old going into college to look to be a Tax Lawyer let alone planning in the next 4 years for it.

Additionally Tax Attorney requires admittance to a state bar. For small businesses and corporations tax attorneys also use. For most people the topic of taxes often elicits some form of disgust.

And unless youre a hedge fund mgr. To be a tax lawyer you must meet the following. Go to Law School in Canada.

Large law firms with a varied tax practice are a common starting point for law school graduates interested in tax law. A tax attorney is a licensed attorney who specializes in tax law. After receiving a bachelors degree and obtaining good LSAT score you can apply for law schools.

Here what youll need to start working as a tax attorney. To become a tax attorney it is important to earn a bachelor degree first. To do that you almost always have to work for an extremely large firm.

The good news if you overpay youll get that money back in the form of a tax return. A tax lawyers work can range from interpreting newly passed legislation to applying long-standing law. The road to becoming a tax attorney starts in college.

That being said the majority of the high level planning work happens with federal income tax issues. Bachelors degree Youre only requirement is to have finished a 4-year program from a universityhowever it certainly helps if you have a Bachelor of Science in a business or. Or otherwise exceedingly wealthy and if.

There are 24 law schools in Canada each of which offers a professional law degree in one or both of Canadas law systems. Tax attorneys spend their time trying to ease the financial burdens associated with both. Earn your juris doctor degree JD which typically takes three years.

Joining this lucrative career means opening the door. Take the full ride tier 2 isnt a bad place to be. Answer 1 of 6.

Just stay and work your way up if you want to work at the B4. This includes four years of pre-law and a minimum of three years of law school. Typically reports to a manager or head of a unitdepartment.

The best electives for aspiring tax attorneys include general business taxation financial services and estate planning just to name a few. Aside from a college education tax attorneys need to pass the bar to be able to practice in their state. From there your tax lawyer can make a suggestion about how much you put in every quarter.

Afer completing graduation take the bar exam. Further your career by becoming an IRS enrolled agent to represent clients in tax disputes. Some tax lawyers also study for an additional year to earn an LLM.

Hire a tax attorney if youre one of the unlucky 25 getting audited this year or if youre dealing with any other tax controversies. After all regardless of ones feeling about whether taxes should be higher or lower almost no one likes seeing a big chunk of her paycheck disappear each month. As a tax lawyer youd be on the front lines of some of the most influential law there is.

5 hours of recognized credit with the University of Phoenix. For individuals tax attorneys use trusts gifts and various tax planning structures to reduce the burdens of income taxes and estate taxes and they assist in devising investment strategies. Apply for a summer internship at a tax law firm after your first year of law school to gain valuable experience and increase your chances of finding employment after graduation.

Gaining exposure to some of the complex tasks within the job function. I can say that tax law is truly an incredibly fun and intellectually engaging field. Answer 1 of 4.

After receiving a bachelors degree and obtaining. Get B4 experience in consultingtax and when you want aim for regional law firms not big law but not tiny practices. Students will receive the following.

Tax accountants prepare tax returns for individuals or organizations and help clients ensure they correctly complete all relevant tax documents. If your business faces legal tax issues you need to hire a tax attorney because they have a deeper understanding of the legalities in the US. While many law schools offer specialized certifications in this field or even a specialized masters degree called an LLM in the subject this credential is not required.

Once tax attorneys have become EAs they are granted unlimited practice rights when representing clients before the IRS. A tax lawyer can look at your expenses compared to your income and evaluate what your quarterly expenses should be. Press J to jump to the feed.

I M A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irs S Crosshairs Ama R Cryptocurrency

These Are The Most Useful Online Courses You Can Take According To Reddit Online Learning Sites Online Courses Learning Sites

Meet Parham Khorsandi Esq Tax Attorney Shoutout La

Irs Tax Audits How Likely How To Handle Them David Klasing

Why You Need A Small Business Tax Attorney Silver Tax Group

10 Things To Say Instead Of Stop Crying Coolguides Stop Crying Crying When Someone

I M A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irs S Crosshairs Ama R Cryptocurrency

Irs Tax Audits How Likely How To Handle Them David Klasing

Why You Need A Small Business Tax Attorney Silver Tax Group

Tax Accountant Career Overview

Accountingtoday Article Is It Too Hard To Become A Cpa Practitioners Speak Out R Accounting

Tax Law Good Field Or Not R Lawschool

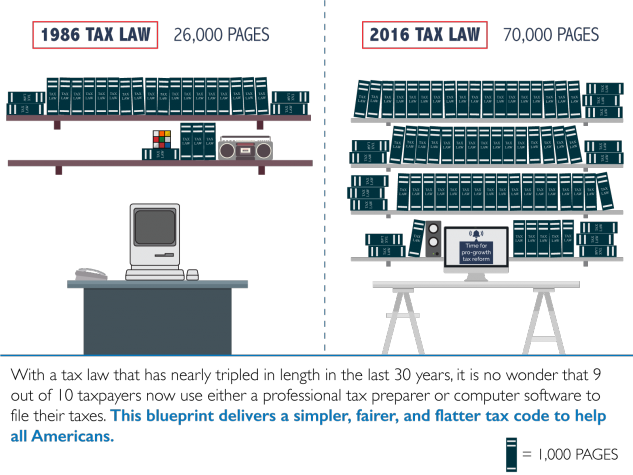

The Myth Of The 70 000 Page Federal Tax Code Vox

How To Work Part Time In Tax Prep And Why You Would Want To Intuit Official Blog

Redditnbastreams National Basketball Association Basketball Leagues Places To Visit